|

KPMG Luxembourg has developed outstanding technical know-how in EU tax matters and is now filing

claims on behalf of Luxembourg investment funds in many countries, such as France, Germany, Poland, etc.

Through these projects, our EU Tax team has gained experience in mobilizing and coordinating dedicated

people and skills within the KPMG network to be able to quickly and efficiently respond to your needs.

KPMG Luxembourg can assist you in filing claims in all countries that infringe EU law by applying a discriminatory

tax treatment to cross-border dividend distributions.

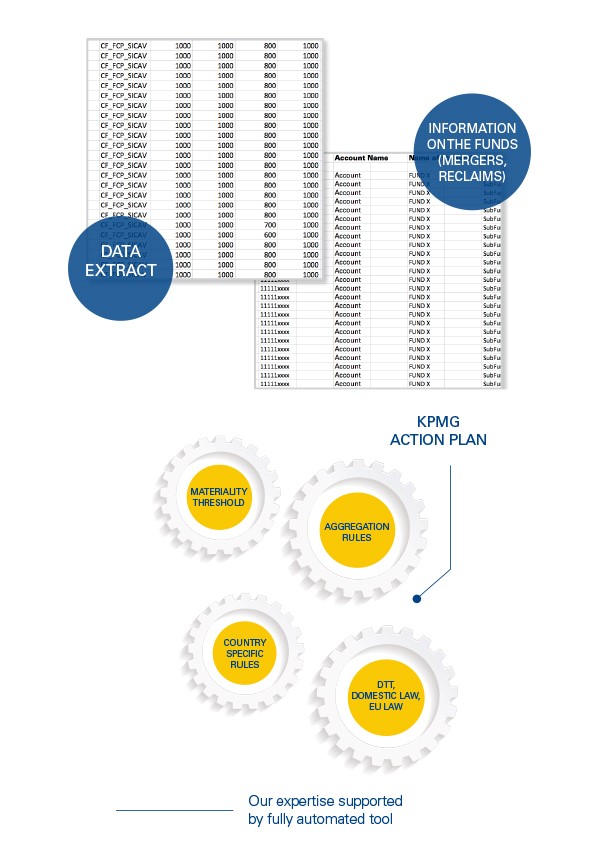

To ensure that investment funds can benefit from the best possible performance applying the most favorable withholding

tax (WHT) rates, KPMG Luxembourg has developed the KPMG WHT Health Check, a fully automated tool, especially designed for

this purpose. The KPMG WHT Health Check will verify on a worldwide basis whether investment funds benefit from reduced WHT

rates and/ or file WHT reclaims based on domestic law, Double Tax Treaties or EU law. KPMG Luxembourg analyses in more

than 90 investment markets if WHT has correctly been applied to your funds.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular

individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such

information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should

act on such information without appropriate professional advice after a thorough examination of the particular situation.

|